Earned Wage Access Platforms Gain Traction as Employers Offer Early Pay to Reduce Reliance on Payday Loans

Earned wage access is quickly becoming a viable option for Australians experiencing temporary financial difficulties. This approach provides an alternative to expensive payday loans by allowing workers to take out loans against salaries they have already earned.

The financial services industry in Australia is undergoing a significant change as companies use earned wage access platforms to relieve the strain on employees, over half of whom are living paycheck to paycheck.

By eschewing the strictness of conventional fortnightly pay cycles, this strategy gives workers greater freedom and less dependence on pricey credit products. The increasing use of these platforms reflects a shift in payroll procedures as well as a larger trend toward workplace financial wellbeing.

Rising Financial Stress Drives Market Demand

Concerning patterns in Australian households’ financial stability are revealed by recent research. One in three Australians, regardless of income level, lack the $500 necessary for unexpected costs, according to analysis, indicating vulnerability that goes far beyond lower-income groups.

With an average payday loan debt of $997 compared to just $250 for elders over 65, Generation Z workers confront specific difficulties. In the current economic climate, younger Australians are disproportionately affected by cost-of-living pressures, as this disparity demonstrates.

Annual pay increase of 3.4% is reported by the Australian Bureau of Statistics, although pressures on consumer prices for basic services are still increasing. The desire for alternative financial solutions has been sustained due to the disparity between income growth and living expenses.

Traditional payday loans continue to be costly for customers. Current ASIC regulations allow for startup costs of up to 20% of the loan amount in addition to 4% monthly fees for payday loans. For a normal emergency loan of $1,200, customers must pay $240 up front and $48 each month, for a total of $2,016 in repayments over a 12-month period.

In contrast, earned wage access systems give employees instant access to their pre-earned income instead of imposing additional debt. No interest rates or credit checks are needed, and the majority of platforms charge flat transaction costs ranging from 1.3% to 1.5%.

Consumers can better understand their options during financial emergencies by using financial comparison websites such as CashPal, which show the significant cost differences between traditional payday loans and new salary access solutions.

Corporate Adoption Accelerates Across Industries

Access to earned wages as a strategic labor management tool is becoming more and more acknowledged by Australian companies. Research shows that during the first year of adoption, employee turnover rates drop by 16% and hiring procedures are 27% faster for businesses that offer these advantages.

Employee benefit plans offered by large Australian firms now include earned wage access. These days, Pizza Hut and Hungry Jack’s use integrated workforce management systems to offer on-demand pay access. Retail businesses like Supabarn groceries and McGrath Estate Agents have implemented real-time pay systems, while Accor Hotels offers wage access as part of their extensive employee support packages.

Strong acceptance rates are seen in the retail and hospitality industries, which are primarily characterised by hourly worker arrangements and frequent employee turnover. Younger workers in these areas frequently exhibit the highest demand for flexible pay options.

After earned pay access was implemented, employee satisfaction indicators showed notable gains. According to survey results, 82% of employees said that having real-time pay alternatives improves their employer satisfaction, which strengthens employee loyalty and engagement at work.

Integration of Technology Simplifies Implementation

The administrative load on human resources departments is reduced by modern earned wage access platforms that seamlessly link with the payroll infrastructure already in place. Popular payroll systems like SAP, SuccessFactors, and several HRIS platforms are connected with leading suppliers to give deployment in a matter of minutes.

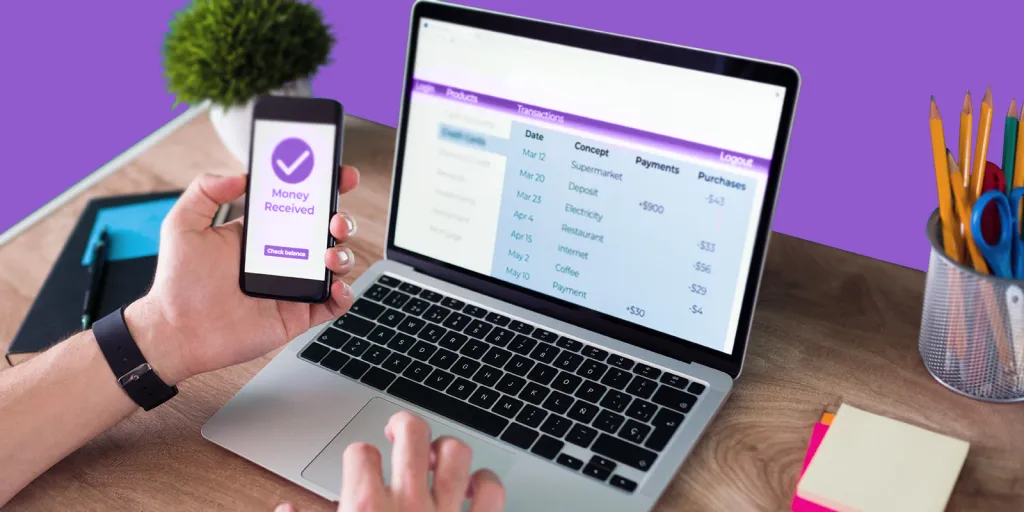

Employees utilise mobile applications as part of the operational process to confirm their employment and request wage advances up to pre-established thresholds, usually 50% of earned but unpaid earnings. Requested amounts are automatically subtracted from upcoming paychecks, preventing extra manual processing and ensuring smooth payroll operations.

Key technological advantages include:

- Employers have no financial responsibility when using third-party funding models.

- Automated adherence to employment terms and award wage computations

- Integrating timesheet approval systems in real time

- Clear pricing schedules without any unstated administrative expenses

By providing employee wage advances and collecting sums through automated payroll deductions, platform providers take on all financial risk. This concept offers instant financial assistance to employees while removing employer exposure.

Regulatory Framework Supports Innovation

Traditional loan products and earned salary access are clearly distinguished by Australia’s regulatory framework. Because wage access platforms give users access to previously earned revenue, they function under different regulations than payday loans, which are governed by consumer credit laws because they create debt.

Current payday loan regulations mandate:

- An establishment fee of no more than 20% of the borrowed funds

- Monthly service charges are limited to 4% of the loan amount.

- Payback caps of 10% of the borrower’s post-tax income

- Required evaluations of responsible lending to avoid financial difficulties

Due to the complete elimination of debt origination, earned pay access circumvents these limitations. By using their own earned cash instead of borrowed money, employees can avoid credit evaluations, interest fees, and negative effects on their credit score.

The recent 3.5% minimum wage rise by the Fair Work Commission, which goes into effect in July 2025, helps workers’ financial circumstances, even though wage growth is still trailing cost-of-living increases in the majority of industries.

Through current workplace laws and fair trade norms, consumer protection frameworks continue to be in place, guaranteeing proper oversight without limiting payroll technology innovation.

Market Consolidation Indicates a Growth Path

Humanforce’s March 2023 acquisition of Wagestream Australia provided important institutional confirmation for Australia’s earned wage access sector. The deal shows increasing faith in the industry’s commercial viability since it is a component of a larger workforce management consolidation.

Comparing the Australian market to its worldwide counterparts, industry data indicates that it is still in its early stages of development. Eighty percent of Fortune 200 firms in the United States currently offer earned wage access, while medical professionals in the United Kingdom have wage access through the National Health Service.

Expectations for real-time payment solutions are still being driven by Australia’s $6.3 billion gig economy. Delivery platforms provide quick payment possibilities, whereas Uber drivers can access their earnings up to five times per day. Because of this exposure to on-demand payments, workers’ expectations for flexible wage access are raised.

According to recent market data, the usage of integrated workforce management and financial wellbeing solutions has grown by 71% per month, indicating that this momentum is persistent and extends beyond particular platform providers.

Financial services firms like CashPal are keeping a careful eye on these changes as cutting-edge payroll systems become a bigger threat to traditional short-term loans.

Organisational Considerations for Implementation

Employers can start by doing thorough financial wellness surveys of their workforce before assessing earned wage access. Stress levels and the need for flexible pay arrangements can be determined through anonymous questionnaires without putting undue pressure on implementation.

Transparent price structures, extensive staff support services, and integration possibilities should be given top priority when choosing a platform. To guarantee successful adoption, top suppliers provide continuing account management, compliance advice, and employee education initiatives.

The system’s capabilities, related expenses, and responsible usage guidelines must all be communicated clearly for installation to be successful. Many platforms encourage sustainable money management practices by incorporating financial education materials and budgeting tools.

Future Market Development

Access to earned wages is more than just a technical development; it signifies a fundamental change in employment payment systems. The idea tackles fundamental issues such as when employees should get their earned income and how businesses might promote financial well-being without taking on more business risks.

Earned wage access offers useful answers for Australian workers as cost-of-living pressures increase and wage growth stays at 3.4%. The technology gives people options and financial dignity, allowing them to handle unforeseen costs without getting into debt cycles.

Better hiring practices, increased employee retention, and the creation of more financially robust workforces are all included in the value proposition for employers. As the Australian market develops, access to earned wages might become as commonplace as benefits like annual leave or superannuation.

Employee expectations and work patterns have changed, which is reflected in the shift from traditional pay cycles to on-demand access. Earned wage access is positioned to end fortnightly salary delays in contemporary Australian businesses, much like digital banking did for branch-based services.