The Benefits of Using Insurance Apps: Convenience, Accessibility, and More

Insurance apps have revolutionized how we manage and purchase insurance policies today. Gone are the days of visiting an insurance office or dealing with piles of paperwork. With just a few taps on your smartphone, you can now purchase a policy, file claims, and renew your insurance without stepping out of your home.

This article explores the various benefits of using an insurance app, highlighting how it offers unparalleled convenience, accessibility, and more. Whether you’re looking for vehicle insurance online or managing your car insurance app, these digital tools are game changers in the insurance industry.

Convenience at Your Fingertips

With traditional methods, purchasing or renewing an insurance policy could take hours or even days. However, with an insurance app, you can complete the entire process within minutes.

- Quick Access to Policies

An insurance app allows you to store all your insurance policies in one place, making it easy to access and review them whenever needed. You no longer have to sift through files or worry about losing important documents.

- Instant Policy Purchase and Renewal

Gone are the days of lengthy procedures and waiting periods. With an insurance app, you can instantly purchase a new policy or renew an existing one. For instance, if you need vehicle insurance online, you can complete the transaction within minutes, ensuring that you’re covered without any delay.

- Effortless Claims Processing

Filing a claim has never been easier. Most insurance apps allow you to initiate and track your claims online, significantly reducing the time and effort involved. You can upload necessary documents, check the status of your claim, and even receive updates directly on your phone.

Enhanced Accessibility

Accessibility is another key benefit of using an insurance app. Whether you’re at home, in the office, or on the go, your insurance needs are just a tap away.

- 24/7 Availability

Insurance apps offer round-the-clock access to your insurance policies. This means you can manage your insurance at any time, without being restricted by business hours. If you need to review your car insurance app while on vacation or make a quick update to your vehicle insurance online in the middle of the night, you can do so without any hassle.

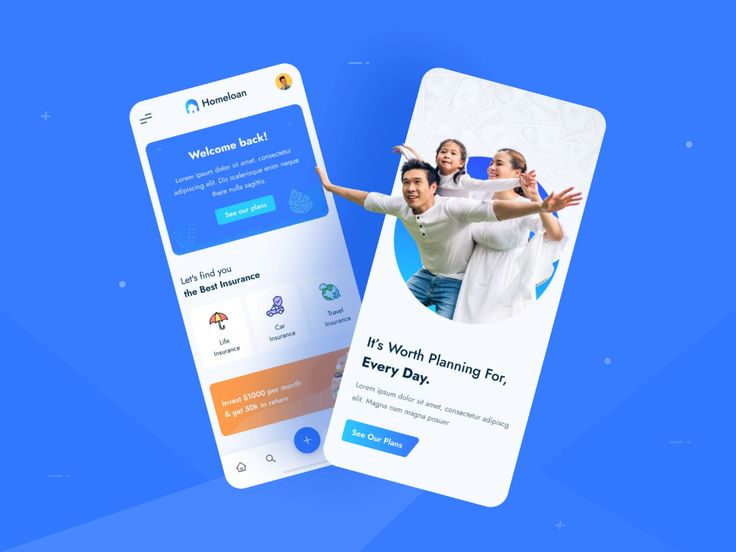

- User-Friendly Interface

Modern insurance apps are designed with user experience in mind. They feature intuitive interfaces that make navigation simple, even for those who aren’t tech-savvy. From purchasing policies to filing claims, every function is easily accessible, ensuring a smooth and stress-free experience.

- Multiple Language Support

Many insurance apps offer support for multiple languages, making them accessible to a broader audience. This feature ensures that language barriers do not hinder you from managing your insurance effectively.

Personalized Experience

Insurance apps are not just about convenience and accessibility; they also offer a highly personalized experience tailored to your specific needs.

- Custom Notifications

With an insurance app, you can set up custom notifications to remind you of important dates, such as policy renewals or premium due dates. This ensures that you never miss a deadline and can avoid any lapses in coverage.

- Tailored Policy Recommendations

Many insurance apps analyze your insurance needs based on your profile and offer tailored policy recommendations. For example, if you’re looking for vehicle insurance online, the app can suggest policies that best match your driving habits, vehicle type, and coverage preferences.

- Quick Quote Generation

Insurance apps often come with a built-in feature that allows you to generate quotes instantly. This feature is particularly useful if you’re comparing different car insurance app options. You can enter your details, and the app will provide quotes from various providers, helping you make an informed decision.

Security and Reliability

When dealing with sensitive information like insurance policies, security is of utmost importance. Insurance apps are designed with robust security measures to ensure your data is protected at all times.

- Data Encryption

Most insurance apps use advanced encryption technologies to protect your personal and financial information. This means that your data is safe from unauthorized access, whether you’re purchasing vehicle insurance online or managing your existing policies.

- Two-Factor Authentication

Many insurance apps require two-factor authentication, adding an extra layer of security to ensure no one would be able to log in without the second form of verification.

- Reliable Customer Support

In case you encounter any issues while using an insurance app, most providers offer reliable customer support. Whether you need help with the car insurance app or have questions about your policy, you can quickly get assistance through chat, email, or phone.

Cost-Effectiveness

Using an insurance app can also be cost-effective, offering potential savings on premiums and administrative costs.

- Lower Premiums

Few insurance companies give discounts when you buy policies through their app. These discounts are often passed on to customers because the cost of managing policies through an app is lower than traditional methods.

- No Need for Middlemen

By using an insurance app, you can directly interact with the insurance provider, eliminating the need for intermediaries. This not only reduces costs but also ensures that you get accurate information straight from the source.

- Access to Special Offers

Insurance apps often feature special promotions or offers that are exclusive to app users. Whether it’s a discount on your vehicle insurance online or a cashback offer on your car insurance app, these deals can lead to significant savings.

Simplify Your Insurance Management with Bajaj Finserv

The benefits of using an insurance app are undeniable. From unmatched convenience and enhanced accessibility to personalized experiences and cost savings, these apps are transforming how we manage our insurance needs. Ready to experience the future of insurance? Download the Bajaj Finserv app today to manage your policies, purchase vehicle insurance online, and explore tailored solutions that meet your unique needs.