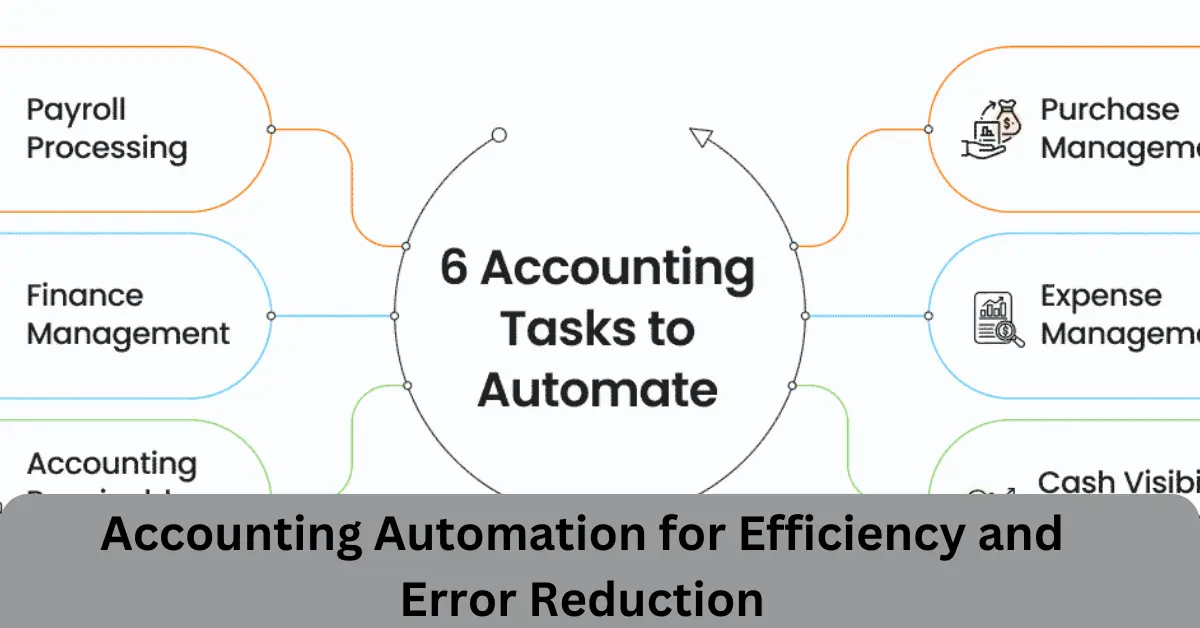

Accounting Automation for Efficiency and Error Reduction

Implementing automation tools can transform accounting from a time-consuming manual task into a streamlined, error-free process. Many small businesses are now utilizing accounting software and P2P systems, along with the expertise of procure to pay professionals, to automate tasks like invoicing, payroll, and expense tracking. Automation minimizes the risk of human error, making it easier to track real-time financial data and manage day-to-day finances. With procure to pay professionals overseeing these processes, business owners can reallocate the time saved from these automated functions toward growth-oriented activities like customer engagement and service improvements. Automation isn’t just a convenience—it’s a vital component in establishing a foundation that can scale efficiently as a business grows.

Setting Financial Goals for Targeted Growth

Having clear, measurable financial goals is essential for small businesses aiming to grow. Defining specific targets, such as a 10% monthly revenue increase or a 15% reduction in overhead costs, gives business owners a roadmap to guide decisions and prioritize investments. Procure to pay professionals can play an important role here by helping structure purchasing processes in alignment with these financial goals. Financial goals serve as benchmarks to assess success, enabling businesses to evaluate whether they are on track to meet their ambitions or if adjustments are necessary. When goals are clearly defined and strategically managed, business owners can create actionable plans that align with these targets, ultimately focusing resources and efforts on areas that contribute most to growth.

Leveraging Cash Flow Forecasting for Financial Stability

Cash flow forecasting is a vital practice that allows small businesses to anticipate upcoming expenses, manage debts, and plan for potential market fluctuations. By predicting when funds will be available or constrained, businesses can make more strategic decisions regarding investments, debt management, and vendor payments. With the support of procure to pay professionals, businesses can streamline their cash flow by automating payment schedules and setting up cost-effective procurement practices. Small businesses that forecast cash flow regularly are better prepared to navigate slow seasons or unexpected downturns. By ensuring liquidity and monitoring accounts payable, procure to pay professionals help business owners maintain the financial stability needed to pursue growth opportunities confidently.

Hiring Accounting Experts and Procure to Pay Professionals for Strategic Insights

Investing in a professional accounting team, including procure to pay professionals, brings a level of expertise that can transform a business’s financial management practices. Professional accountants and procure to pay professionals offer financial oversight and insights into optimizing cash flow, reducing waste, and identifying growth opportunities. By providing expertise in expense management, vendor relationships, and payment workflows, these professionals enable small businesses to reduce unnecessary costs and make strategic investments. For business owners, this means they can focus on scaling their business with confidence, knowing that procure to pay professionals are handling financial processes efficiently and minimizing costly inefficiencies.

Conducting Regular Financial Audits with Procure to Pay Professionals for Efficiency

Regular financial audits give small businesses a comprehensive view of their financial health, enabling them to identify and correct inefficiencies. When procure to pay professionals are involved in these audits, businesses can gain further insights into purchasing behaviors and payment processes, pinpointing areas where funds might be reallocated or expenses streamlined. Audits help uncover inefficiencies in spending patterns, allowing businesses to make data-driven decisions that improve profitability. For instance, an audit may reveal excessive spending on non-essential items, which procure to pay professionals can help manage or eliminate. These adjustments, overseen by procure to pay professionals, ensure that a business is financially healthy and optimized for future expansion.